AFEMAI MICROFINANCE BANK

...the bank for all people

Mission Statement

To be the Engine of growth of Microfinance businesses and Small and Medium Enterprises, SMEs in Afemai land in particular, and Edo State in general.

Vision Statement

To be the best provider of Microfinance Services to Micro businesses and Small & Medium Enterprises, (SMEs) in Afemai land in particular, and Edo State in general.

Services

ONLINE BANKING

With our online banking platform our customers can perform online transactions from the convenience of their home

LOAN

Our loans are tailored to meet the needs of entrepreneurs seeking to start, maintain and grow their small and medium scale businesses.

CHILDREN'S EDUCATION SAVING SCHEME

This product enables parents/guardians plan for their children's education finance through target savings.

FESTIVAL ACCOUNT

Our festival account allows customers save for festive periods

CURRENT, SAVINGS AND FIXED DEPOSIT ACCOUNT

With our savings, current and fixed deposit accounts, our customers are bound to have the best deals

MOBILE BANKING SCHEME

With our mobile banking scheme customers do not need to come to the bank. We will come to you and help you deposit your money in your account. Click here to download our mobile app https://play.google.com/store/search?q=afemai+mfb&c=apps

Privacy Policy

By accessing or using the Services, or by accepting our Terms and Conditions (the “Terms”) or any other terms that incorporate this Privacy Policy by reference, you agree on behalf of yourself and any organization that you represent (together, “you”) that you have read and understood this Privacy Policy and that you consent to the collection, use, and sharing of information as discussed below. If you do not agree with this Privacy Policy, do not access or use the Services or the Platforms. This Policy is incorporated into and made a part of our Terms and Conditions. USERS’ PRIVACY RIGHTS This Policy describes the User’s privacy rights regarding Afemai MFB’s collection, use, storage, sharing and protection of a User’s personal information on the Platforms and in respect of the Services. If a User creates a username, identification code, password or any other piece of information as part of the Platform’s access security measures, such information will be treated as confidential, and will not be disclosed to any third party. Afemai MFB reserves the right to disable any User identification code or password, whether chosen by a User or allocated by the Platform at any time, if in Afemai MFB’s opinion a User has failed to comply with any of the Terms (including this Privacy Policy). If a User is aware or suspects that anyone other than his/herself is aware of a User’s security details, please kindly notify Afemai MFB as soon as possible via the address below. Afemai MFB Limited Data Protection Officer 61B, Bode Road Jattu-Uzairue. info@afemaimfb.org By continuing to use our mobile application (the “Mobile App”), you acknowledge and agree that you have carefully read and understood the terms of use and privacy policy. Your rights in relation to Your Personal Data are as follows: (I) The right to have access to Your Personal Data; (II) The right to be informed about the processing of Your Personal Data; (III) The right to rectify any inaccurate Personal Data or any information about You; (IV) The right to review, modify or erase Your Personal Data and any other information we have about You; (V) The right to restrict the processing of Your Personal Data; (VI) The right to block Personal Data processing in violation of any law; (VII) The right to be informed about any rectification or erasure of Personal Data or restriction of any processing carried out; (VIII) The right to the portability of Your Personal Data; and (IX) The right to lodge a complaint to a supervisory authority within Nigeria. USERS’ PERSONAL INFORMATION Afemai MFB collects and use any information you supply when you interact with the mobile app, you share personal details like your name, Bank Verification Number, Valid Identification, address and picture. By using the mobile app to transact, you also share details of your transactions with us. Additionally, we may request explicit permission to see other information like your address book, location, photos and data from your camera. • Details you give are expected to prove when you sign up on the Mobile App, like your BVN, name, date of birth, gender, phone number, residential address, and email address. • Images would also be collected for the purpose of KYC and other features like adding your profile picture. • Information you give us through the in-app chat so will enable us to serve you better. • We shall also access your contact list information to enable you to perform certain functions like sending airtime and data to a person on your contact list. • We may collect internet protocol (IP) address, browser type, device ID, internet service provider (ISP), information about your computer and software, links materials You request, your approximate location, referring/exit pages, date/time stamp, and other metadata. Platforms may embed Javascript code into page loads, which instructs Users’ web browsers to make web requests back to our servers to collect information about the User page views and other activities. • We collect certain information from the User’s browser using small data files called “cookies”. The Platform may use session cookies to help recognize a User who visits multiple pages during the same session so that the User does not have to enter a password to access each page. Session cookies terminate once the User closes the browser. • We also use persistent cookies to collect, store and track information. The Platform uses persistent cookies to store the User’s login ID (but not the User’s password) to make it easier for the User to login when the User returns to the website. We encode our cookies so that only us can interpret the information stored in them. You can remove or block persistent cookies using the settings in your browser, but this may limit your ability to use our Platform. • We may employ a software technology called clear gifs or web beacons that help us better manage content on the Platform as well as on the Platform emails, by informing us what content is effective. Clear gifs are tiny graphics with a unique identifier, similar function to cookies and are used to track the online movements of the Web users. In contrast to cookies, which are stored on a User’s computer hard drive, clear gifs are embedded invisibly on Web pages and are about the size of the period at the end of this sentence. GOVERNING PRINCIPLES Afemai MFB will always comply with the principles outlined below for the purpose of collecting, storing and using a User’s personal information. • Data shall be collected and processed with a specific, legitimate and lawful purpose which shall be consented to by the User before collection and processing; • Data may be further processed for archiving, scientific research, historical research and statistical purposes for public interest without obtaining the consent of the User; • Data collection and processing shall be adequate, accurate and with consideration for the dignity of the human person; • Data shall only be stored for the period which is reasonably needed and as required by the relevant and applicable laws; and • Data shall be secured against all foreseeable hazards and breaches such as theft, cyberattack, viral attack, dissemination, and manipulations of any kind. The lawful basis we rely on for processing your Personal Information are: • Your consent; Where you agree to us collecting your Personal Information by using our Services. • We have a contractual obligation: Without your Personal Information, we cannot provide our Services to you. Afemai MFB also has a legal obligation to ensure full compliance with all Anti-Money Laundering and Counter-Terrorist Financing Laws. Afemai MFB protects against fraud by checking your identity with your Personal Information. SHARING AND PROTECTION OF USERS’ PERSONAL INFORMATION TO THIRD PARTIES Afemai MFB provides such information to our subsidiaries, affiliated companies or other trusted third-party service providers or persons for the purpose of processing personal information on our behalf, including validating user credentials, securing data storage, marketing, customer service, fraud detection and other applicable services. Afemai MFB requires that these parties agree to process such information based on our instructions and in compliance with this Privacy Policy and any other appropriate confidentiality and security measures we consider essential and relevant subject to applicable law. Afemai MFB requires that these third-parties providers use PII and PID only in connection with the services they perform for Afemai MFB. Afemai MFB may share User information with law enforcement agencies, government officials, or other third parties in the event of a court order or similar legal procedure, regulatory disclosure or when Afemai MFB believes in good faith that the disclosure of User information is necessary or advisable to report suspected illegal activity or to protect Afemai MFB’s property or legal rights. Except as expressly disclosed in this Privacy policy, Afemai MFB will not sell or disclose User information to third parties. Afemai MFB may disclose aggregated or other types of non-personally identifiable information to third parties for various purposes. SECURITY OF USERS’ PERSONAL INFORMATION Afemai MFB has implemented physical, technical, and procedural safeguards to protect User information from unauthorized access, disclosure, alteration, or destruction. Afemai MFB uses computer safeguards such as firewalls and data encryption and authorizes access to personally identifiable information only for those employees, contractors, and agents who require it to fulfil their job responsibilities. Afemai MFB utilizes a higer duty of care to protect User information, such as credit card or bank account numbers, if disclosure of a particular type of User information could cause direct financial loss, Afemai MFB further encrypts such information and transmits it under Secure Socket Layer (SSL). Afemai MFB shall only retain personal information reasonably required to keep providing Services to you. Where we no longer provide services to you, your information will be stored on our servers to the extent necessary to comply with regulatory obligations and for the purpose of fraud monitoring, detection and prevention. Where we retain your Personal Information, we do so in compliance with limitation periods under the applicable law. LOCATION All Personal Information you provide to us is stored on our secure servers as well as secure physical locations and cloud infrastructure (where applicable) for the purposes of providing seamless services to you, including but not limited to ensuring business continuity, the data that we collect from you may be transferred to or stored in cloud locations at globally accepted vendors’ data centre. Whenever your information is transferred to other locations, we will take all necessary steps to ensure that your data is handled securely and in accordance with this privacy policy. DATA CONFIDENTIALITY RIGHTS REPORTING A PERSONAL DATA BREACH Afemai MFB is required to comply with the Nigeria Data Protection Regulation 2019 (“NDPR”) and other relevant laws and regulations regarding reporting requirements in relation to data breaches and report any personal data breach where there is a risk to the rights and freedoms of a User. Where a personal data breach results in a high risk to a User, such a User also has to be notified unless subsequent steps have been taken to ensure that the risk is unlikely to materialise, security measures were applied to render the personal data unintelligible (e.g. encryption) or it would amount to disproportionate effort to inform the User directly. In the latter circumstances, a public communication must be made, or an equally effective alternative measure must be adopted to inform such a User, so that he/she can take any necessary remedial action. CHANGES TO THIS POLICY We may amend this Privacy Policy at any time by posting a revised version on this page. The revised version will be effective at the time we post it unless we provide additional notice or an opportunity to “opt-in” because changes are material or retroactive. If you keep using our Services, you consent to all amendments to this Privacy Policy.

Afemai MFB Mobile App. link for Corporate Accounts

https://ibanktwo.blob.core.windows.net/qoreblob/afemaimfb/afemaimfb-app-20250619.1.apk

Afemai Mobile App. link for Individual Account

https://play.google.com/store/apps/details?id=com.afemaimfb.afemaimfbmobile&pcampaignid=web_share

Contact

- AFEMAI MICROFINCE BANK JATTU

- 312102

Management Team

Directors

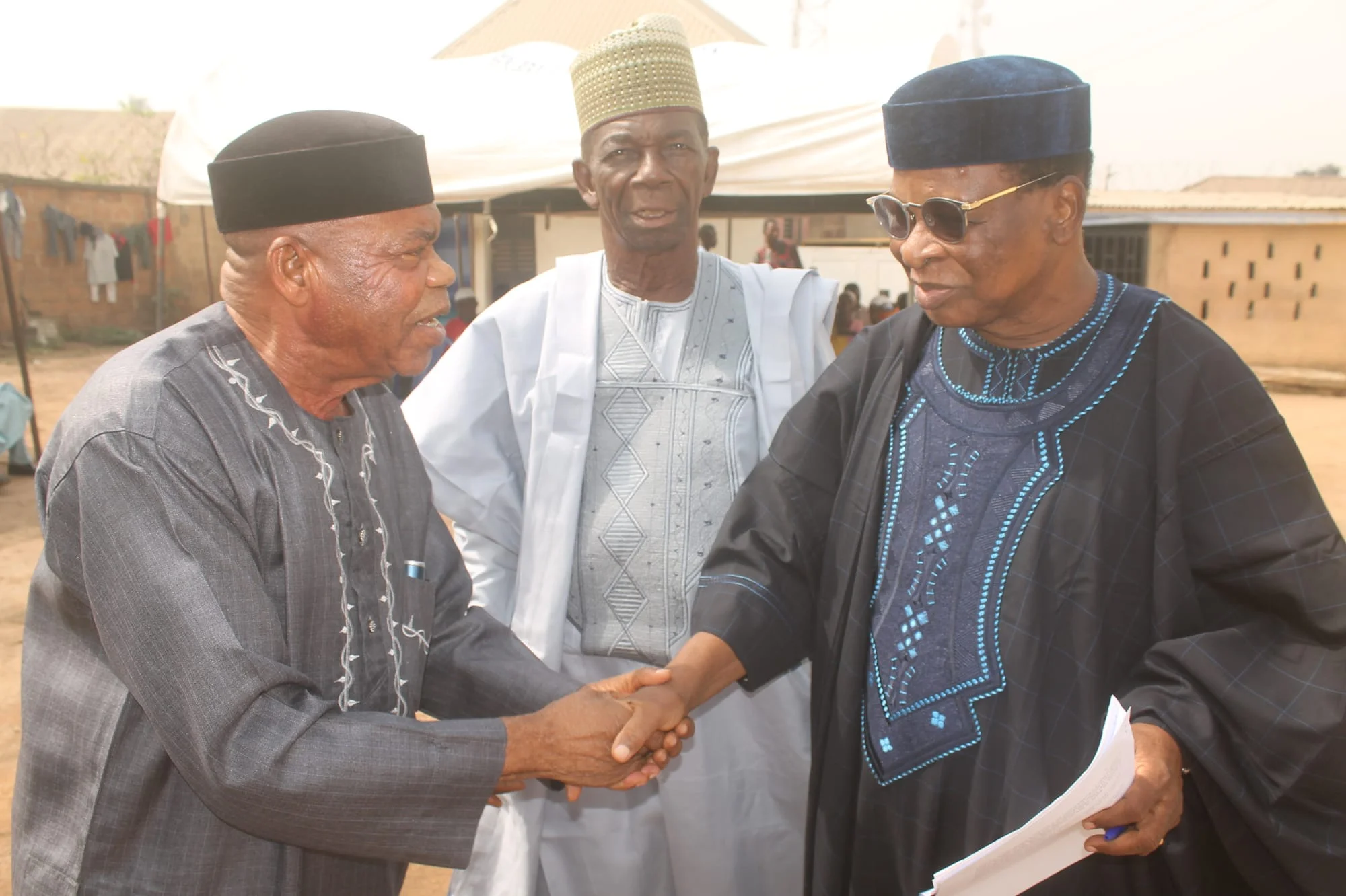

CHIEF PIUS AKPAIBOR

CHAIRMAN

Chief Akpaibor holds the second Class Upper B.Sc Degree in Accounting and a Masters Degree in Business Administration.

Prof. Momodu Kassim-Momodu

DIRECTOR

Prof. Momodu Kassim-Momodu holds LL.B (Hon), BL, LL.M, M.Sc, PhD, Oxford Certificate in Management Studies, Chartered FCIPD, FCArb. He is presently Professor of Law and Dean College of Law, Crescent University, Abeokuta.

BASIL DAMISAH

DIRECTOR

Mr. Damisah holds B.Sc (Econs) Hons, Ibadan and MBA, Benin. His working experience spans Thirty years of unbroken Banking career in UBA.

Engr. Ogie-Aitsabokhai, Lemmy Yakubu

DIRECTOR

Engr. Lemmy Yakubu Ogie-Aitsabokhai is a retired Chief Lecturer at theAuchi Polytechnic, Auchi. He attended St. Phillip’s Catholic School, Jattu-Uzairue; Our Lady of Fatima College, Auchi and the University of Benin, Benin-City where he obtained the First School Leaving Certificate (1970); The West African School Certificate O/L (1975); The B.Eng. (Hons.) (1982) and M.Eng. (Civil) (1997) respectively. He had worked in the industry before joining the services of Auchi Polytechnic, Auchi in 1996 as a Lecturer I and rose progressively to the rank of a Chief Lecturer in 2006. He retired from the service in 2022 and currently works as a Civil Engineering Consultant. A man of considerable academic and administrative experience; He is also a member of several professional bodies among which are The Nigerian Society of Engineers (MNSE); The Council for the Regulation of Engineering in Nigeria (COREN);The Nigeria Institution of Civil Engineers (MNICE); The Nigerian Institute of Management (MNIM);Fellow, Institute of Corporate Administration of Nigeria (FCAI).

Shuaibu, Mohammad Lawal

DIRECTOR

Shuaibu, Mohammad Lawal, holds a Bachelor of Agriculture (Second Class Upper Division) at the University of Nigeria Nsukka, PGD (Management) Ahmadu Bello University, Zaria, Nigeria, M.Sc. Investment Banking and Islamic Finance (IBIF) University of Reading (ICMA Centre) Reading Berkshire, and Senior Management Program (SMP) Lagos Business School Pan African University, Lagos

Udukhoboh Mark Akpaibor

DIRECTOR

Udukhoboh Mark Akpaibor is an alumnus of King’s College, Lagos and a graduate of Covenant University Ota with a BSc (2nd class upper) degree in Economics. Mark is a member of the Institute of Chartered Accountants of Nigeria (ICAN) and the Chartered Institute of Taxation of Nigeria (CITN) with a career spanning over 15 years. He is an avid reader & writer.

ALOYSIUS AINOYOMOH

MD/C.E.O

Mr. Ainoyomoh has been in the banking industry for over two decades. He holds a B.Ed. in Accounting from Ambrose Alli University Ekpoma.

Privacy-Policy

Mobile App

By accessing or using the Services, or by accepting our Terms and Conditions (the “Terms”) or any other terms that incorporate this Privacy Policy by reference, you agree on behalf of yourself and any organization that you represent (together, “you”) that you have read and understood this Privacy Policy and that you consent to the collection, use, and sharing of information as discussed below. If you do not agree with this Privacy Policy, do not access or use the Services or the Platforms. This Policy is incorporated into and made a part of our Terms and Conditions. USERS’ PRIVACY RIGHTS This Policy describes the User’s privacy rights regarding Afemai MFB’s collection, use, storage, sharing and protection of a User’s personal information on the Platforms and in respect of the Services. If a User creates a username, identification code, password or any other piece of information as part of the Platform’s access security measures, such information will be treated as confidential, and will not be disclosed to any third party. Afemai MFB reserves the right to disable any User identification code or password, whether chosen by a User or allocated by the Platform at any time, if in Afemai MFB’s opinion a User has failed to comply with any of the Terms (including this Privacy Policy). If a User is aware or suspects that anyone other than his/herself is aware of a User’s security details, please kindly notify Afemai MFB as soon as possible via the address below. Afemai MFB Limited Data Protection Officer 61B, Bode Road Jattu-Uzairue. info@afemaimfb.org By continuing to use our mobile application (the “Mobile App”), you acknowledge and agree that you have carefully read and understood the terms of use and privacy policy. Your rights in relation to Your Personal Data are as follows: (I) The right to have access to Your Personal Data; (II) The right to be informed about the processing of Your Personal Data; (III) The right to rectify any inaccurate Personal Data or any information about You; (IV) The right to review, modify or erase Your Personal Data and any other information we have about You; (V) The right to restrict the processing of Your Personal Data; (VI) The right to block Personal Data processing in violation of any law; (VII) The right to be informed about any rectification or erasure of Personal Data or restriction of any processing carried out; (VIII) The right to the portability of Your Personal Data; and (IX) The right to lodge a complaint to a supervisory authority within Nigeria. USERS’ PERSONAL INFORMATION Afemai MFB collects and use any information you supply when you interact with the mobile app, you share personal details like your name, Bank Verification Number, Valid Identification, address and picture. By using the mobile app to transact, you also share details of your transactions with us. Additionally, we may request explicit permission to see other information like your address book, location, photos and data from your camera. • Details you give are expected to prove when you sign up on the Mobile App, like your BVN, name, date of birth, gender, phone number, residential address, and email address. • Images would also be collected for the purpose of KYC and other features like adding your profile picture. • Information you give us through the in-app chat so will enable us to serve you better. • We shall also access your contact list information to enable you to perform certain functions like sending airtime and data to a person on your contact list. • We may collect internet protocol (IP) address, browser type, device ID, internet service provider (ISP), information about your computer and software, links materials You request, your approximate location, referring/exit pages, date/time stamp, and other metadata. Platforms may embed Javascript code into page loads, which instructs Users’ web browsers to make web requests back to our servers to collect information about the User page views and other activities. • We collect certain information from the User’s browser using small data files called “cookies”. The Platform may use session cookies to help recognize a User who visits multiple pages during the same session so that the User does not have to enter a password to access each page. Session cookies terminate once the User closes the browser. • We also use persistent cookies to collect, store and track information. The Platform uses persistent cookies to store the User’s login ID (but not the User’s password) to make it easier for the User to login when the User returns to the website. We encode our cookies so that only us can interpret the information stored in them. You can remove or block persistent cookies using the settings in your browser, but this may limit your ability to use our Platform. • We may employ a software technology called clear gifs or web beacons that help us better manage content on the Platform as well as on the Platform emails, by informing us what content is effective. Clear gifs are tiny graphics with a unique identifier, similar function to cookies and are used to track the online movements of the Web users. In contrast to cookies, which are stored on a User’s computer hard drive, clear gifs are embedded invisibly on Web pages and are about the size of the period at the end of this sentence. GOVERNING PRINCIPLES Afemai MFB will always comply with the principles outlined below for the purpose of collecting, storing and using a User’s personal information. • Data shall be collected and processed with a specific, legitimate and lawful purpose which shall be consented to by the User before collection and processing; • Data may be further processed for archiving, scientific research, historical research and statistical purposes for public interest without obtaining the consent of the User; • Data collection and processing shall be adequate, accurate and with consideration for the dignity of the human person; • Data shall only be stored for the period which is reasonably needed and as required by the relevant and applicable laws; and • Data shall be secured against all foreseeable hazards and breaches such as theft, cyberattack, viral attack, dissemination, and manipulations of any kind. The lawful basis we rely on for processing your Personal Information are: • Your consent; Where you agree to us collecting your Personal Information by using our Services. • We have a contractual obligation: Without your Personal Information, we cannot provide our Services to you. Afemai MFB also has a legal obligation to ensure full compliance with all Anti-Money Laundering and Counter-Terrorist Financing Laws. Afemai MFB protects against fraud by checking your identity with your Personal Information. SHARING AND PROTECTION OF USERS’ PERSONAL INFORMATION TO THIRD PARTIES Afemai MFB provides such information to our subsidiaries, affiliated companies or other trusted third-party service providers or persons for the purpose of processing personal information on our behalf, including validating user credentials, securing data storage, marketing, customer service, fraud detection and other applicable services. Afemai MFB requires that these parties agree to process such information based on our instructions and in compliance with this Privacy Policy and any other appropriate confidentiality and security measures we consider essential and relevant subject to applicable law. Afemai MFB requires that these third-parties providers use PII and PID only in connection with the services they perform for Afemai MFB. Afemai MFB may share User information with law enforcement agencies, government officials, or other third parties in the event of a court order or similar legal procedure, regulatory disclosure or when Afemai MFB believes in good faith that the disclosure of User information is necessary or advisable to report suspected illegal activity or to protect Afemai MFB’s property or legal rights. Except as expressly disclosed in this Privacy policy, Afemai MFB will not sell or disclose User information to third parties. Afemai MFB may disclose aggregated or other types of non-personally identifiable information to third parties for various purposes. SECURITY OF USERS’ PERSONAL INFORMATION Afemai MFB has implemented physical, technical, and procedural safeguards to protect User information from unauthorized access, disclosure, alteration, or destruction. Afemai MFB uses computer safeguards such as firewalls and data encryption and authorizes access to personally identifiable information only for those employees, contractors, and agents who require it to fulfil their job responsibilities. Afemai MFB utilizes a higer duty of care to protect User information, such as credit card or bank account numbers, if disclosure of a particular type of User information could cause direct financial loss, Afemai MFB further encrypts such information and transmits it under Secure Socket Layer (SSL). Afemai MFB shall only retain personal information reasonably required to keep providing Services to you. Where we no longer provide services to you, your information will be stored on our servers to the extent necessary to comply with regulatory obligations and for the purpose of fraud monitoring, detection and prevention. Where we retain your Personal Information, we do so in compliance with limitation periods under the applicable law. LOCATION All Personal Information you provide to us is stored on our secure servers as well as secure physical locations and cloud infrastructure (where applicable) for the purposes of providing seamless services to you, including but not limited to ensuring business continuity, the data that we collect from you may be transferred to or stored in cloud locations at globally accepted vendors’ data centre. Whenever your information is transferred to other locations, we will take all necessary steps to ensure that your data is handled securely and in accordance with this privacy policy. DATA CONFIDENTIALITY RIGHTS REPORTING A PERSONAL DATA BREACH Afemai MFB is required to comply with the Nigeria Data Protection Regulation 2019 (“NDPR”) and other relevant laws and regulations regarding reporting requirements in relation to data breaches and report any personal data breach where there is a risk to the rights and freedoms of a User. Where a personal data breach results in a high risk to a User, such a User also has to be notified unless subsequent steps have been taken to ensure that the risk is unlikely to materialise, security measures were applied to render the personal data unintelligible (e.g. encryption) or it would amount to disproportionate effort to inform the User directly. In the latter circumstances, a public communication must be made, or an equally effective alternative measure must be adopted to inform such a User, so that he/she can take any necessary remedial action. CHANGES TO THIS POLICY We may amend this Privacy Policy at any time by posting a revised version on this page. The revised version will be effective at the time we post it unless we provide additional notice or an opportunity to “opt-in” because changes are material or retroactive. If you keep using our Services, you consent to all amendments to this Privacy Policy.